In June 2025, China's automotive market exhibited distinct characteristics of 'slight overall growth and structural changes' driven by policy benefits and consumer upgrades. Data from Gaishi Automotive shows that a total of 2.49 million new cars were sold nationwide in June, marking a year-on-year growth of 15.1% and a month-on-month increase of 7.5%, setting a historical sales record for June. Behind this achievement lies a deep competition between the new energy vehicle and traditional fuel vehicle markets, indicating that a new round of 'power transition' in the Chinese automotive market is nearing a decisive moment. The best-selling sedan list for June 2025 reveals a clear structural transformation across various segments, showcasing a revolution led by domestic brands and driven by new energy, fundamentally rewriting the rules of the game in China's auto industry.

In the A00 segment, mini electric vehicles, represented by the Hongguang MINI EV and Changan Lumin, have proven their worth amidst discussions about 'consumption downgrade,' which is essentially an upgrade in precise demand. The current domestic microcar market is not short of orders, with a continued surge in scenario-based demand. However, higher safety standards are pushing micro electric vehicles to upgrade continuously.

The Hongguang MINI EV's long-standing dominance in the A00 segment is no accident. Its design accurately addresses the core demands of short-distance travel, with a compact body that can maneuver easily through narrow city streets and crowded parking lots. Its absolute cost-performance advantage is easily accepted by consumers. Over the years, the product prowess of the Hongguang MINI EV has been evolving, with significant upgrades in range and safety features in new models, alleviating consumer concerns about safety while effectively meeting daily commuting needs. Additionally, SAIC-GM-Wuling's 'scenario-based marketing' has contributed significantly, targeting young consumers with updated versions and offering various personalized modification options.

Changan Lumin also stands out as a representative of refined small cars carving out a niche. In a market dominated by boxy designs, the Lumin's more rounded design attracts a considerable number of female consumers. Equipped with Changan's self-developed 'smart connection system,' it supports voice control, rearview camera, and mobile remote control functions, providing practical utility for this class of vehicle. As urbanization accelerates, short-distance commuting has become a frequent necessity for many consumers, and the compact and agile A00 models perfectly fit urban travel scenarios.

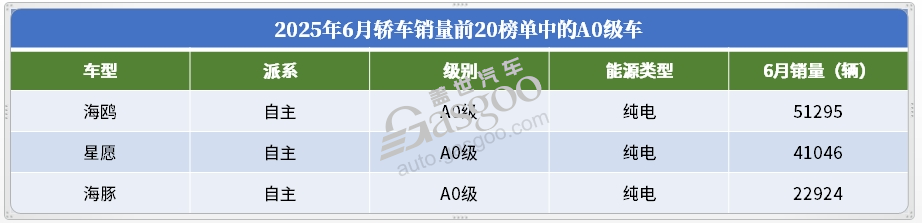

In the A0 segment, domestic new energy products have risen significantly, with models like BYD Seagull, Geely Xingyuan, and BYD Dolphin each selling over 20,000 units in June. The Seagull has emerged as a technical powerhouse in the A0 small car market, selling over 50,000 units in June, leading the sedan market. The new Seagull not only features upgrades in range and charging but also includes the 'God Eye' driving assistance system, alongside a youthful sporty design and impressive tech ambiance, enhancing its competitive edge.

Geely Xingyuan has shown remarkable performance as a newcomer in the subdivided market with more than 40,000 units sold in June. Built on a new pure electric platform, the Xingyuan boasts spaciousness and smart configurations, with a 2650mm wheelbase comparable to some A-class cars, establishing a solid competitive advantage in the A0 segment.

The Dolphin, an A0 market veteran, maintained nearly 20,000 units sold in June, demonstrating considerable market vitality. Currently, the A0 segment has become a stronghold for domestic electric vehicles, with domestic automakers rapidly applying new technologies like efficient motors, smart cockpits, and assistance systems, significantly enhancing market competitiveness.

The A segment continues to be a battleground for old and new forces, showcasing fierce competition between joint venture models like Langyi, Suteng, and Xuanyi, and domestic models like Qin PLUS and Emgrand. Suteng, a sporty A-class car from Volkswagen, targets young families and driving enthusiasts, with over 20,000 units sold in June. While several joint venture A-class fuel vehicles maintain market share, the overall environment indicates that joint venture brands face unprecedented challenges due to the rapid rise of domestic new energy products.

In the B segment, domestic brands are also making a comeback, with models like Seal 06 and Qin L performing strongly, threatening the traditional joint venture B-class vehicles. The Seal 06 and Qin L have become leading products in the domestic mid-size car market, each selling over 20,000 units monthly. Tesla's Model 3 remains a benchmark product in the B-class electric sedan market, selling over 20,000 units in June, reflecting the brand's ongoing adaptation to competitive pressures.

In the C segment, the Xiaomi SU7 has emerged as a formidable contender, winning the sales championship in June. With a starting price of 215,900 yuan and equipped with Xiaomi's smart cabin system, it leverages the brand's ecological advantages to offer a seamless smart travel experience.

In summary, the analysis of China's automotive market in June 2025 reveals significant shifts in market dynamics. The A00 segment remains vibrant through scenario advantages and safety upgrades, while the A0 segment has become a battleground for domestic electric vehicles. The A segment showcases fierce competition between new and old forces, with domestic new energy models gaining ground. The B segment reflects a reversal of fortunes for domestic brands, and in the C segment, new entrants challenge traditional luxury brands, emphasizing the importance of ecology and technology. Domestic brands are increasingly excelling, particularly in the new energy sector, forming a competitive advantage through technological innovation and precise market positioning, continuously squeezing the market space of joint venture and traditional luxury brands. Moving forward, the focus will remain on new technologies, evolving consumer demands, and shifting competitive landscapes, with companies adapting to trends and innovating to thrive amidst challenges.

China's Automotive Market Sees Structural Changes Amid Policy Benefits and Consumer Upgrades in June 2025

Images

Share this post on: