Amidst the intertwined trends of intelligence, electrification, and software-defined vehicles, the technological focus of automobiles is undergoing a profound shift. The chassis, long viewed as a mechanical and passive subsystem of vehicles, is now receiving unprecedented attention and strategic value. According to McKinsey's "2030 Automotive Industry Outlook," the global intelligent chassis market is expected to exceed $80 billion by 2025, with over 60% of that being related to steer-by-wire technology. The competition in chassis technology has entered a 2.0 phase, evolving from a passive carrier to an 'intelligent motion control hub.' Historically, the chassis has primarily been the terminal carrier for vehicle functionality, focusing on mechanical performance, response speed, and structural strength. However, as vehicles evolve toward electrification and intelligence, the chassis has transformed from traditional to electric, and now to intelligent chassis, becoming a crucial extension of intelligent decision-making and perception capabilities.

The development of automotive chassis has gone through significant changes due to electrification, which reassesses the spatial structure of the chassis, including battery placement, front and rear drive distribution, and brake logic reconstruction. Furthermore, advancements in autonomous driving technology demand higher execution precision and redundant control capabilities from the chassis to enhance stability and safety. Additionally, the emergence of software-defined vehicles is pushing the chassis out of its 'functional island,' integrating with body control, power control, and even intelligent cockpit functions. In this context, systems like electric brake control, steer-by-wire, intelligent suspension, and sensors have transitioned from optional technological highlights to foundational infrastructures supporting vehicle intelligence, iteration, and system upgrade capabilities. This encapsulates the core concept of 'intelligent chassis.'

The development of intelligent chassis can be categorized into three stages based on varying degrees of wire control and collaboration across three axes. In stage 1.0, the intelligent chassis achieves partial wire control in the X and Y directions, equipped with domain control and standardized interfaces. In stage 2.0, the chassis achieves partial full wire control across the X, Y, and Z directions, with software-defined integration and 'vehicle-road collaborative perception' capabilities becoming focal points in the current intelligent chassis market.

Many automotive manufacturers are now launching intelligent chassis products. For instance, prior to the Shanghai Auto Show, Huawei unveiled its XMC digital chassis engine; NIO's ET9 features a fully wire-controlled intelligent chassis; and Geely's first hardcore off-road SUV, the Galaxy Battleship, highlights its AI digital chassis as a core selling point. The enthusiasm of automotive companies for intelligent chassis indicates a substantial market potential. According to forecasts, the market size of core systems for wire-controlled chassis in China's passenger vehicles alone is expected to reach 65 billion yuan by 2026, with a compound annual growth rate of 35.4% from 2022 to 2026, primarily driven by wire-controlled braking, steering, and suspension systems.

Facing the expansive intelligent chassis market, foreign Tier 1 suppliers with years of experience in China are accelerating their market response. ZF, a global leader in chassis technology, is also hastening its efforts in this area. ZF's Chassis 2.0 strategy aims to create a modular platform centered on 'intelligent interconnected actuators + software-hardware decoupling + multi-domain collaborative capability,' emphasizing the chassis's role as a critical support point in software-defined architecture. This strategy is not just about iterating single-point technology but represents a structural upgrade in thinking.

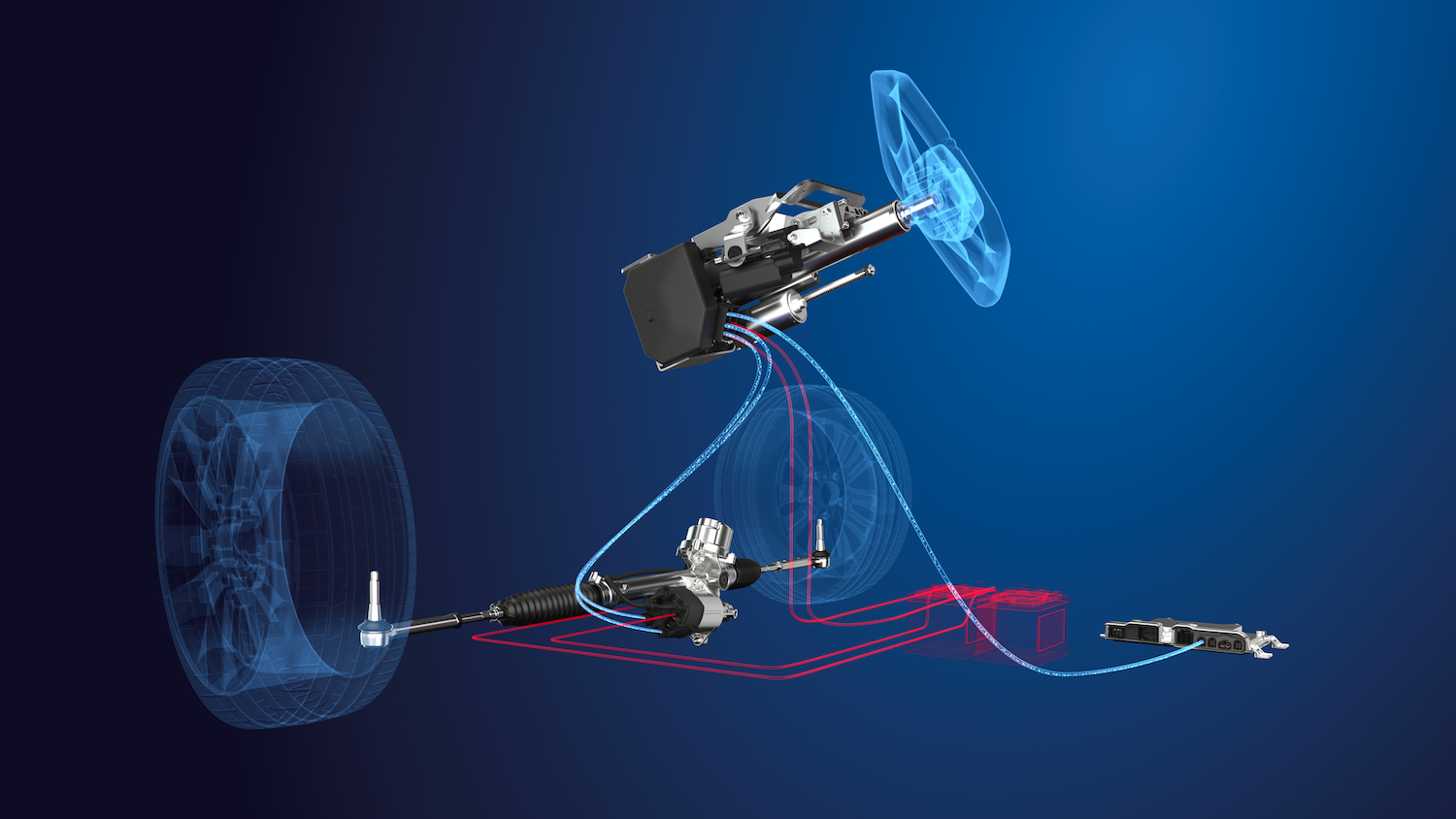

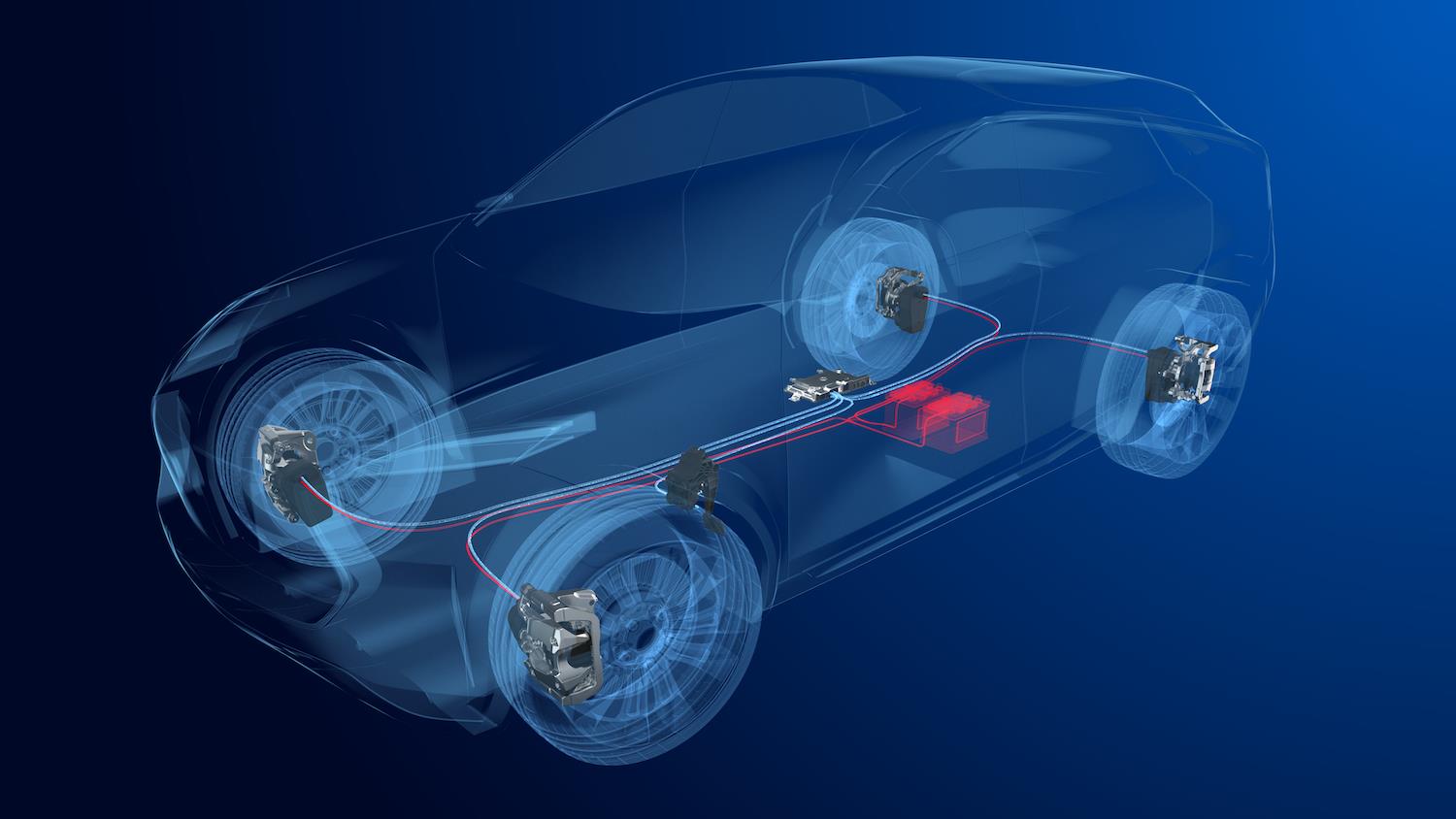

In terms of lateral control, ZF's steer-by-wire system employs simulators to provide steering feel feedback and electronic actuator control while ensuring safety through multiple redundancy mechanisms, completely breaking the physical connection between the steering wheel and the steering mechanism. Earlier this year, the NIO ET9 became the first production vehicle in China to feature ZF's full-stack steer-by-wire system. Following that, ZF secured orders from two other Chinese automakers and partnered with Mercedes-Benz, planning to start production in 2026. In longitudinal control, ZF's Chinese R&D team successfully implemented its second-generation integrated braking control system (IBC Gen2) in 2022, significantly improving the reliability of braking systems while saving costs. Additionally, ZF's dry wire-controlled braking system (EMB) has received orders from a leading global automaker, with plans to equip nearly 5 million vehicles with this technology.

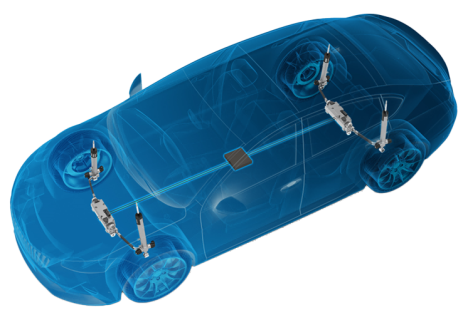

ZF's Chassis 2.0 product portfolio also includes active and semi-active suspension systems. Having launched its first semi-active continuously variable damping control system (CDC®) 25 years ago, ZF now holds a 40% global market share in this field. Its fully active suspension system, sMOTION®, addresses a longstanding challenge in passenger vehicle chassis design: achieving stability and dynamic handling without sacrificing comfort. Currently in mass production, sMOTION® will be applied to new models from Porsche, such as the Panamera and Taycan, and has been recognized by top domestic automobile brands in China, set to begin production at ZF's Chinese factory next year.

Furthermore, software-hardware decoupling is a key aspect of ZF's Chassis 2.0 strategy. ZF is one of the few in the industry capable of independently providing specialized software services, regardless of whether their related actuators are supplied. Central to this is the cubiX vehicle motion control software, which seamlessly coordinates longitudinal, lateral, and vertical dynamic control components through unified control logic. Even if certain chassis components are not ZF products, cubiX ensures smooth driving as per the manufacturer's specifications. This platform is currently in mass production, and ZF has launched the cubiX Tuner, a tool designed for automakers to simplify the complex process of chassis calibration. This innovative tool significantly shortens development cycles, directly meeting customer demands for faster development processes and cost reductions.

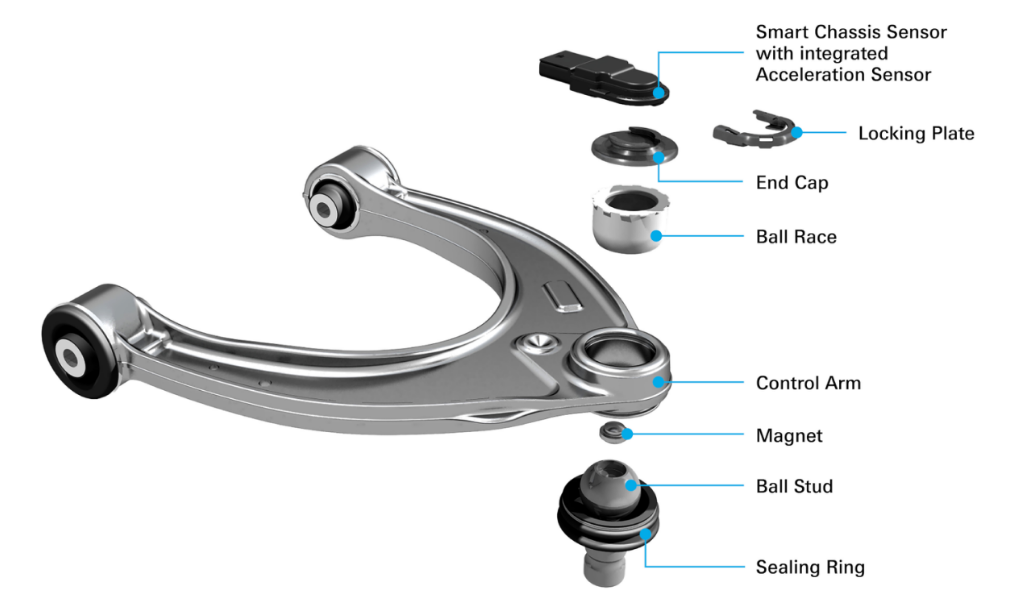

As market demand for new chassis functionalities continues to rise, ZF is deeply integrating hardware and software technologies, exemplified by its latest intelligent chassis sensor, which is integrated into the ball joint to accurately measure the relative motion of the vehicle body. The data collected by this sensor has been implemented for controlling key chassis functions, already in mass production on the Cadillac CELESTIQ. ZF's product lineup covers nearly all components in the chassis domain, and as ZF Group's board and Head of Chassis Solutions Division Dr. Peter Holdmann stated, the Chassis 2.0 product portfolio integrates all three directions of chassis control, aiming for optimal control across these dimensions. With a strong understanding of the performance of every component in the chassis, ZF can maintain optimal vehicle performance during integration control, establishing a dual leading position in both market and technology across all key areas of the Chassis 2.0 product portfolio.

The intelligent chassis is set to become a new focus for differentiation in overall vehicle performance. Dr. Alexander Hägele, Vice President of ZF's Automotive Chassis Solutions Division for Asia-Pacific, emphasized that decades ago, the engine was the core differentiator in vehicle manufacturing; however, with advancements in electric drive, differentiation in drive systems is becoming increasingly minor, and the real differentiation in overall vehicle performance will come from the chassis rather than the power system. Recognizing this shift, ZF integrated its passenger vehicle chassis technology and active safety technology divisions to form the new Chassis Solutions Division, consolidating all of ZF's chassis expertise to provide all necessary hardware components for controlling vertical, longitudinal, and lateral dynamics, along with related software and hardware matching. This division employs approximately 33,000 people and operates in 60 production locations worldwide, with projected sales of €10.1 billion in 2024. Dr. Li Yao, the head of system design for ZF's Automotive Chassis Solutions Division in Asia-Pacific, noted that as the importance of passenger vehicle chassis continues to rise, Chassis 2.0 will become the most important engine for ZF's further growth, with projected sales of approximately €4.8 billion from related products by 2030 and a global market share expected to reach 33%. While this forecast is forward-looking, challenges remain. Despite the maturity of intelligent chassis technology, it is still transitioning to mainstream markets, necessitating breakthroughs in cost control, regulatory standards, and system compatibility for widespread adoption. Additionally, it's noteworthy that an increasing number of automakers are leaning towards developing key systems in-house, such as Tesla and BYD, which have begun to accumulate capabilities in chassis control and software definition. For traditional Tier 1 suppliers, transitioning from 'single-point supply' to 'joint development' and 'platform collaboration' with customers has become crucial. ZF's Chassis 2.0 blueprint, with its efforts in open architecture and software-hardware decoupling, as well as ongoing initiatives to build a software ecosystem and enhance platform flexibility, provides a feasible path for the industry.

The Rise of Intelligent Chassis in the Automotive Industry

Images

Share this post on: